NEWS & ANALYSIS: Utah's R1 RCM has Boosted its Value by ~60% in Just One Month as it's Now Agreed to be Acquired in an All-Cash Deal at a Valuation of $8.9 Billion by TowerBrook and Clayton, Dubilier & Rice

Sometimes, the best decision is to "hold out for a better offer."

Just because you get asked to "Go to Prom," there's nothing compelling you to accept the invitation.

Or invitations, as the case may be.

Clearly, the executive team and board of directors of Murray, Utah-based R1 RCM (NASDAQ:RCM) understand the potential benefit of "holding out for the better offer."

Hence, even though R1 received a formal $5.58 billion "Take Private" offer on 01 July 2024 from New Mountain Capital — as reported by Utah Money Watch in "Utah-based R1 RCM Receives Updated All-Cash 'Take Private' Offer of ~$5.58 Billion from New Mountain Capital in a Proposed 'Go It Alone' Deal" — the reality is that R1 continued to remain open to other potential opportunities.

I, for one, suspect its shareholders are now grateful that that was the approach the R1 Board took. Why?

Because R1 RCM has now reached a formal agreement to be acquired by TowerBrook Capital Partners and Clayton, Dubilier & Rice at an all-cash valuation of $8.9 billion.

A quick trip to a calculator tells anyone that $8.9 billion represents a jump of 60% in R1's corporate valuation in just one month.

That. Is. Insane!!!

{NOTE: Here's a link to the news release announcing R1 has accepted the acquisition offer that values the firm at $8.9 billion.}

As such, R1 shareholders will receive $14.30/share of common stock when the acquisition closes, not counting TowerBrook which already holds ~36% of R1's common stock.

Post-acquisition, R1's shares will no longer trade on a public stock market, hence the term "take private" to describe the acquisition.

TowerBrook is a Certified B Corporation that describes itself as "... a purpose-driven, transatlantic investment management firm that has raised in excess of $23 billion to date" with investments in over "... 90 companies on both sides of the Atlantic."

Conversely, CD&R is a partner-owned private investment firm with a portfolio covering "... industrial, healthcare, consumer, technology and financial services end markets."

According to R1 RCM's news release announcing its acquisition, the parties expect the acquisition to close prior to 01 January 2024, subject to "... subject to customary closing conditions, including receipt of stockholder approval and regulatory approvals."

A Quick R1 RCM Snapshot

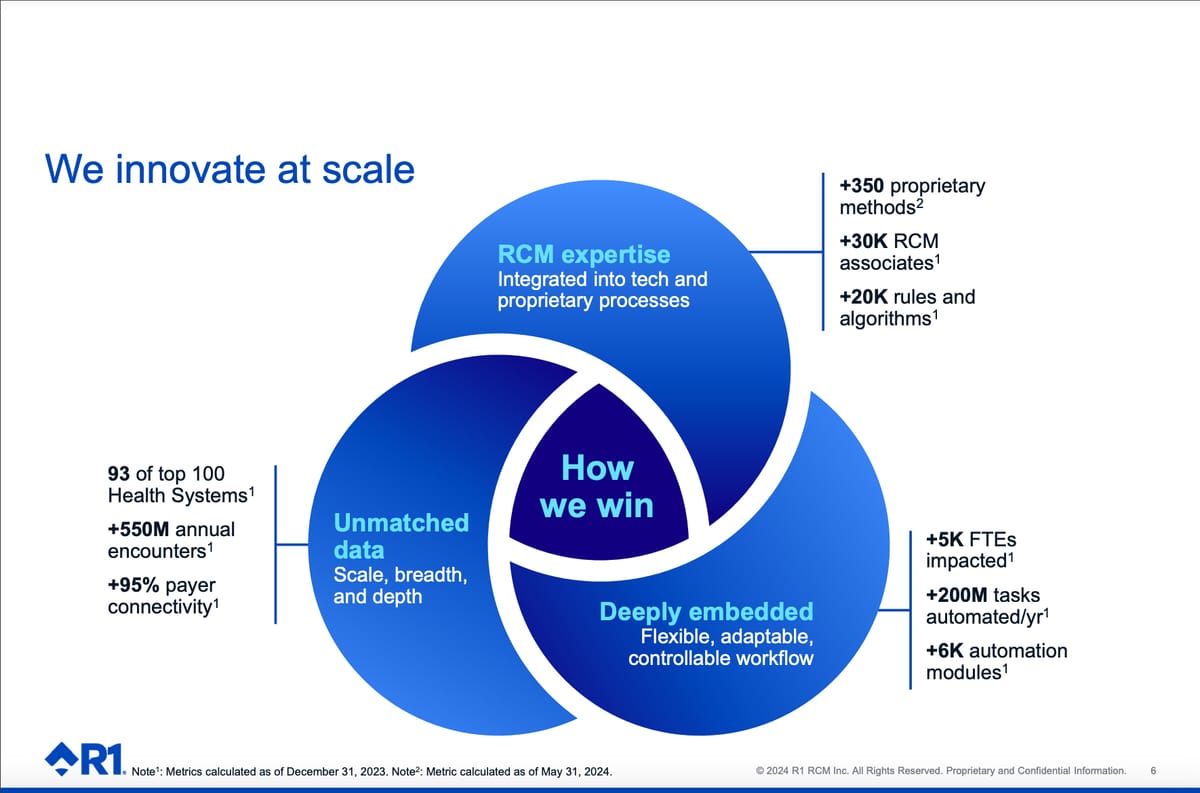

As noted in our 05 July 2024 report, R1 "... was established roughly 21 years ago in 2003 as Accretive Health, a company that provided 'end-to-end revenue cycle management' products and services to hospital networks and healthcare providers.

"In simplest terms, such RCM products/services allow healthcare organizations to optimize their revenue-generating efforts and maximize net income, specifically by

- "Automating financial activities that are currently handled manually,

- "Eliminating mistakes in the process,

- "Identifying and capturing missing revenue,

- "Helping providers more effectively and efficiently use personnel,

- "Improving employee satisfaction, and

- "Boosting patient retention and revenue."

So ... although acquisition discussions actually began over 2.5 years ago in January 2022, 21-year-old R1 RCM is finally set to become a private company once again.

PUBLISHER'S NOTE

In case you're not aware of Utah Money Watch, our goal is to publish Utah-focused monetary, financial, and/or business news, context, and analysis on a timely/regular basis, ideally information NOT available through any other source.

[You might think of us at the opposite of Bloomberg, CNBC, and/or The Wall Street Journal, each of which focus on international/national news first and rarely report on local happenings. Conversely, we are passionately focused on uncovering the most important monetary, financial, and/or business news and information that impact the organizations and people of Utah.]

Here again, the intent is to publish news, information, context, and analysis NOT available through any other source.

To that end, this article was originally published and distributed to our Subscribers at approximately 7:40am (MT) on Wednesday, 07 August 2024.

However, if you are seeing this report sometime after this date/time and you are interested in seeing similar reports and/or other Utah-focused monetary/financial/business news, context, and analysis write-ups in the future on an instantaneous basis when they are published, you can do so by subscribing, FOR FREE, to Utah Money Watch.

This will take less than 30 seconds and can be done from any page on the Utah Money Watch website.

Simply,

1. Click on a "Subscribe" button on any Utah Money Watch webpage,

2. Enter in your name in the proper field in the popup window that appears on-screen, and

3. Enter your preferred email address in the proper field too.

That's it. And "Yes," it really is that simple.

And ... it IS free.

So we hope to see you join us as a subscriber of Utah Money Watch.

Thanks.

Team Utah Money Watch

Comments ()