Mea Culpa: Updating my Story About Swig's Move Into Franchising and Its Coming Transition to Multi-Unicorn Status

AUTHOR'S NOTE: One week ago, 25 August 2023, I published this story on Utah Money Watch: "Swig Lands an Estimated $134 Million in One-Time Revenue as it Sells 250 New Stores to 12 New Franchise Partners."

Unfortunately, several of the underlying financial assumptions included in that story were incorrect. For that I apologize: to Swig, its founders/executives, to Swig's new franchise partners, The Larry H. Miller Company, Savory Management, and to you, the subscribers, followers, and fans of Utah Money Watch.

Nevertheless, there was much in my original story that was correct, especially the news aspects of the story itself, as well as the incredible journey of Team Swig during its 13-year journey to today.

So ... I revisit Swig's franchising news below (and more), and then I add my updated/revised estimations and calculations on why I still believe Swig is well on its way to achieving "2X+ Unicorn Status" by the end of 2024.

Humbly,

David Politis,

Founder, Editor, & Publisher

Utah Money Watch

Swig Signs 12 Partners that Purchase a Combined 250 Franchise Locations

Last Thursday, 24 August 2023, Lehi, Utah-based Swig announced it had successfully begun franchising efforts by selling 12 partners the rights to launch a combined 250 franchise locations.

With these first 250 franchise locations, Swig will expand into seven new markets:

- Arkansas,

- Idaho,

- Florida,

- Missouri,

- North Carolina,

- South Carolina, and

- Tennessee.

Additionally, the comany said it expects to "commit 500 (total) franchise units by the end of the year."

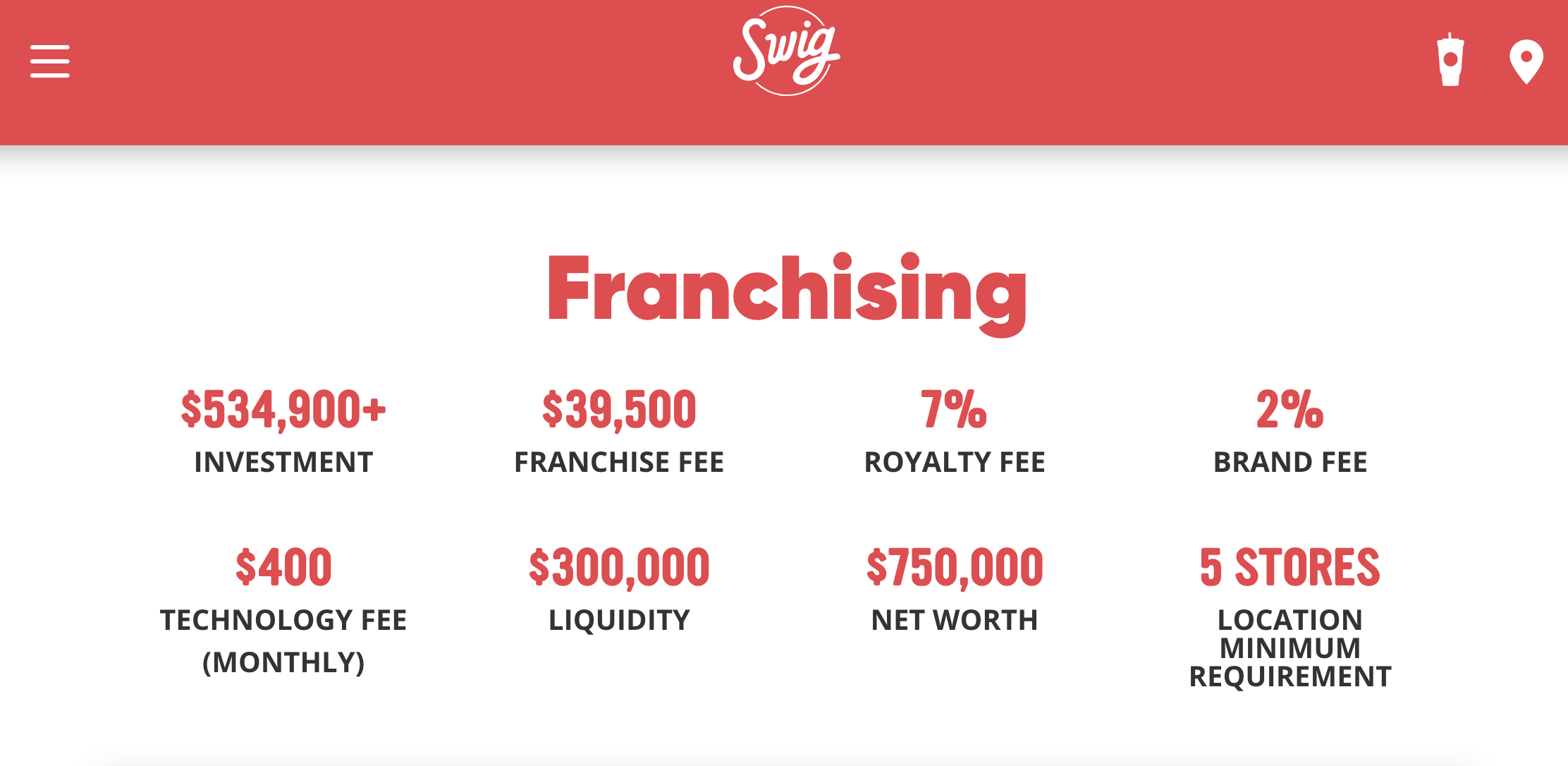

As noted in the image below (captured yesterday from Swig's Franchising page), potential franchisees must have a Net Worth of at least $750,000, with $300,000 in "liquidity," and commit to franchise at least 5 Swig stores.

Additionally, these multi-unit franchisees can expect to

- Pay Swig a Franchise Fee of $39,000 (presumably per unit, but that is not clear from this page),

- Invest $534,900 (or more) per unit (some of which may actually go to Swig for the purchase of authorized equipment and Supplies - more on this later in this writeup),

- Pay combined Royalty and Brand Fees of 9% (again, this is not stated, but typically such fees are paid annually based upon gross revenue/unit), and

- Pay a monthly Technology Fee of $400 (expected to be per store/month).

Based upon this data, I calculate that Swig generated combined one-time Franchise Fees of $9.875 million*, in aggregate, from its 12 new franchise partners for their commitments for the 250 new Swig stores.

AUTHOR'S NOTE: With minor exceptions, the following two sections have been copied from the 25 August 2023 writeup about Swig.

A Brief Swig History — Retold (In Part)

As I wrote in February 2021 for Deseret Business Watch, Nicole and Todd Tanner "decided to take the plunge into what they described as the 'Dirty Drink' market (aka, specialty sodas) by opening their own store called Swig (in St. George, Utah)." That was in 2010.

Roughly seven years later, Swig was acquired in an undisclosed, all-cash deal by Four Foods Group in December 2017, the then nine-year-old, Utah-based Top 100 Restaurant Management Company which was founded and led by the husband and wife team of Andrew and Shauna Smith.

However, by the end of 2019, Four Foods Group had sold all of its Kneader's and Little Caesar's franchise units, positioning the Smiths and their team for new opportunities.

As it turned out, the most attractive opportunity for the former Four Foods Group execs was the creation of Savory Management, a value-add management company that collaborated with Utah-based Mercato Partners, one of the oldest and largest venture capital firms in the Rocky Mountain region.

In turn, that collaboration led to Andrew Smith joining Mercato as a Managing Partner of its newly formed investment fund, the Savory Restaurant Fund, a growth investment vehicle focused on emerging Quick Serve Restaurant concepts.

At the time of the Mercato/Savory Management collaboration, Savory folded three QSR chains into the Mercato/Savory family:

- Mo'Bettahs Hawaiian Style Food;

- R&R Barbeque; and yes,

- Swig.

Since the Savory/Mercato tie-up, a total of $200 million has been raised in two separate funds, and Savory has now made investment bets on seven additional brands, including

- 86 Repairs;

- Crack Shack

- Hash Kitchen

- PINCHO Burgers + Kebabs;

- Saigon Hustle;

- The Sicilian Butcher; and

- Via 313 Pizzeria,

for a total of nine QSR chains and one QSR service company (86 Repairs).

The Sale of Swig and its Future — Retold

Since Savory purchased Swig in 2017, Savory was on track to grow the "Dirty Drink" and treats chain to over 46 locations by the end of 2022, more than double the number of units at the time of the acquisition.

But the Swig profile changed dramatically last November when the Larry H. Miller Company announced it had purchased a majority ownership stake in Swig from Savory for an undisclosed amount.

At the time, Gail Miller, Owner of the LHM Company, said,

"I am proud to invest in Swig, a business founded by a woman whose approach to community building aligns with ours. Nicole and the team are invested in their leaders and employees, and their values are strongly reflected in their everyday operations."

Rerunning the Numbers: Known's, Unknown's, and Guesstimates

So ... what does it all mean, at least from a corporate valuation standpoint, for Swig and its owners?

Given my opening mea culpa, let's start with what I do and do not know, along with some Best Guesses.

First, the Known's.

Swig Known #1: Revenue per Store

According to this December 2020 article by the Deseret News, Swig had 30 locations at the time.

One month later, Swig mentioned in a news release that it had reached $30 million in annual sales.

This makes the calculation of per store revenue in January 2021 quite simple: $1 million/store/year, 2.5X greater than my original estimate of annual per store revenue one week ago.

Swig Known #2: 70 "O&O" Swig Stores

According to last week's news release about its entrance into franchising, Swig announced that it will have "70 corporate-owned locations" (aka, Owned & Operated corporate stores) by the end of the year (before 1 January 2024).

Swig Known #3: 500 Swig Franchise Locations Committed by the End of 2023

In the same news release, Swig stated:

"The company projects that by the end of the year, it will reach its target of 500 committed franchise units."

Next, some Guesstimates.

Swig Guesstimate #1: Opening Date for Franchise Unit No. 500

How long will it take for Swig's partners to get all 500 initial franchise units up and operational? Great question.

Presuming that the company's expectations are correct — that it will have committments for 500 franchise units by the end of 2023 — I suspect that all 500 stores will be open for business no later than 31 December 2024.

Swig Guesstimate #2: Current Annual Revenue per Swig Store

Has Swig been able to increase its average annual revenue per store since 2020? I believe so.

Given the operational excellence of both Savory Management and The Larry H. Miller Company, plus U.S. inflation rates** of

- 1.23% inflation in 2020,

- 4.70% inflation in 2021,

- 8.00% inflation in 2022, and

- 4.90% inflation through the first six months of 2023,

I feel strongly that average annual revenue per Swig store is now over $1.2 million per location.

Now, the Unknown's.

Swig Unknown #1: Real Estate

{AUTHOR'S NOTE: This may seem like I'm getting off-track, but I'm not, so stick with me.}

I believe that one of the most relavatory points of the 2016 movie The Founder is when Ray Kroc meets Harry Sonneborn for the first time.

Sonneborn, you may recall, was the Vice President of Finance for Tastee-Freeze, and after convincing Kroc to visit with him, he proceeds to tell Kroc (in the movie):

"You don't seem to realize what business you're in. You're not in the burger business. You're in the real estate business."

The character playing Sonneborn then drives this mind-blowing point home even further with this statement:

"You don't build an empire off a 1.4% cut of a 15-cent hamburger. You build it by owning the land upon which that burger is cooked."

According to several sources, that conversation led to the creation of an entity within the burger giant named McDonald's Franchise Realty Corp. {NOTE: Kroc ended up hiring Sonneborn as McDonald's first President/CEO, positions he held from 1959 until 1967.}

As outlined in the 25 June 2022 WorkWeek article, "McDonald's $42B Real Estate Empire, Explained", MFRC owns roughly

- "55% of (the) land under (its store) locations (+ long-term leases for the rest), and

- "80% of (the) buildings (that house McDonald's stores)."

Because McDonald's owns much of the land and buildings that house its franchise locations, it collects lease payments from its franchisees, while also benefiting from the appreciation (if any) from these holdings.

So ... what primary business is Swig in?

- The Dirty Drink industry?

- The Real Estate industry?

- Some other industry altogether? (See Unknown No. 2 below.)

- Or ... some combination of the above?

Given the long-term focus of LHM Companies on Real Estate (dating back to its earliest days in the car dealership realm), I suspect Swig is now a Real Estate company AND a Dirty Drink company AND is also in a third industry: Supplies. (See below.)

Swig Unknown #2: Supplies

No restaurant chain — from Fine Dining to Quick Serve (or anything in between) — can exist without Supplies.

To be clear, it's possible for any multi-location chain to maintain Quality Control and Quality Assurance by letting its local managers (and/or franchise owners) determine where and how to purchase what supplies from what vendors at what prices.

Conversely, corporations can instead say,

"Nope. Every item you/we sell and/or use, we will supply to you."

In the case of Swig, that could mean literally everything,

- From Soda Syrup to Beverage Cups, and

- From Uniforms to Order-taking Computer Tablets, as well as

- Any other consumable a store might need/use.

By becoming a "Supplier" (if it isn't one already), Swig would not only increase its expected QA/QC outcomes, but it would also open up a new line of revenue.

So ... is Swig also a Supplier to its Franchisees?

I believe the answer is yes.

One Final Guesstimate: Comps

As any homeowner or real estate industry professional can tell you, if you want to know what a home is worth, you have to look at its Comps.

Determining Comps (an abbreviation of Comparables) is a fairly straightforward method of looking for houses that are similar to others by such standards as

- Square footage,

- Number of bedrooms,

- Number of bathrooms,

- Lot size,

- Age of the home,

- Etc.

Naturally, it's rarely possible to find one house that's truly identical to another unless the same contractor built both using the same plans on identically sized and situated lots.

But that's where Comps come into play because what homeowners and homebuyers are actually looking for is the answer to this queston:

"Is this house 'comparable,' in value, to this house."

The same approach is often used in business when one tries to assign a value to one firm by answering a similar question:

"Can I find one firm (where I know its value) and then extrapolate a comparable valuation for a second firm?"

Typically, the easiest way to do this is to start (if possible) with a publicly traded company, a firm where certain data is already known.

In this instance, I believe the best starting point for identifying possible Comps for Swig is Starbucks.

Obviously, Starbucks is over 500X bigger than Swig just by comparing the number of stores both have in operation today.

And selling variations of coffee (as your foundational product line) is clearly different than selling customized soda drinks.

But beverages are still beverages, and I feel there are more things similar between the two firms than dissimilar.

So ... why is that important? Because then Starbucks can be reasonably used as an initial Comp starting point for analyzing Swig's valuation.

For instance, in fiscal 2022 (ended 2 October 2022), Starbucks

- Generated global revenue of $32.25 billion from

- 35,711 stores worldwide, resulting in

- Average annual revenue/store in FY 2022 of $903,000.

Separately, MacroTrends reported that for FY 2022,

- Starbucks' EBITDA (earnings before income tax, depreciation, and amortization) in FY 2022 was $6.147 billion, or

- An EBITDA percentage of 19.06% against FY 2022 revenue of $32.25 billion.

AUTHOR'S NOTE: Apologies up front; things are about to get pretty geeky.

Getting to a Swig Valuation of over $2 Billion

It then comes down to utilizing the Known or Guesstimated points about Swig outlined above.

For example, by the end of 2024, Swig should have

- 500 franchise stores in operation, with

- 70 separate corporate-owned stores in operation as well.

Each store should generate an average of $1.2 million in annual revenue, with franchisees paying Swig

- Annual Royalty Fees of 7% (or $84,000 per store per year); plus

- Annual Brand Fees of 2% (or $24,000 per store per year); plus

- Annual Technology Fees (or $400 per month per store or $4,800/year/store).

Taken together, Swig should collect nearly $113,000 in Fees per year for each Franchise unit; that's roughly $55 million in annual total Franchise Fees.

Because such Fees carry minimal expenditures, especially if you throw-out half of the Technology Fees to cover any actual tech expenses incurred by Swig itself, that means that $55 Million is essentially a straight EBITDA contribution to the Profit & Loss statement of Swig corporate.

On top of that, however, Swig's O&O stores will also generate average annual revenue of $1.2 million per store or $84 million in gross revenue/year.

Therefore, using the Starbucks Comp of 19.06%, that produces an O&O EBITDA for these 70 Swig stores of $16 million.

When combined, that gives Swig (the parent company) a combined annual EBITDA of ~$71 million starting in 2025, just from Franchise Fees and the EBITDA produced by its 70 O&O stores.

According to its 2023 Industry Insights Report, Kroll suggests an average valuation multiple range of 15.2X to 19.6X that when applied to the EBITDA of restaurant chains will produce an estimated value for said chains.

By utlizing the higher Kroll multiple, that pegs Swig's valuation at roughly $1.353 billion at the end of 2024, a number I am quite confident in.

However, that total does not take into account what I feel is the high likelihood that Swig is also in the Real Estate business, as a

- Landowner,

- Building owner,

- Master lease holder, or

- A combination thereof. Nor does it take into account

- The likelihood that Swig will also serve as a contractural Supplier to its Franchisees.

I think the likelihood that Swig does not operate in the Real Estate and/or Supplier industries is essentially zero.

Hence, if any or all of the five items listed above are correct, Swig "Corporate" will clearly generate additional income streams from its endeavors in these industries, endeavors which, in turn, will lead to additional contributions to its annual EBITDA, and therefore increase its valuation as well.

In addition, if Swig Corporate is in the Real Estate business as a landowner and/or building owner, then its valuation will be further improved, both from

- A physical assets standpoint, as well as from

- An appreciation standpoint for those assets.

In Conclusion: Swig — A 2X+ Unicorn by 2025

So ... based upon everything spelled out above, plus my expectation of continued inflation of a minimum of 3% per annum through 2024, at a bare, bare minimum,

I predict Swig will be worth north of $2 billion before the start of 2025.

How much more?

I'm not sure, unless I can get my hands on a Franchisee contract or internal Swig P&L documents.

But for now, I'll stick with my 2X+ Unicorn Status prediction for Swig.

* — Is it possible Swig will generate additional income from its franchise partners by requiring them to purchase store equipment from it at a markup? Yes. But without knowing if this is true or not, specific guesstimates about possible additional income are NOT included in this writeup.

** — U.S. inflation rate data for 2020, 2021, and 2022 was provided by Macrotrends, whereas Trading Economics data shows that the average monthly U.S. inflation rate through the first six months of 2023 was 4.9%.

Comments ()