Is Angel Studios Really Worth $1.58 Billion? It Thinks So.

In a two-week period spanning late August into the second week of September, Provo, Utah-based Angel Studios has made three major financial moves designed to transform both the firm and its financial future —

ONE: It launched a crowdfunded Reg A+ fundraising;

TWO: Angel raised $20 million through that offering in under two weeks; and

THREE: It announced plans for a SPAC Merger, which (if successful), would immediately transform Angel Studios into a publicly traded company and value itself at nearly $1.6 billion.

Talk about a wild 14 days!!!

On the one hand, it was crazy enough to me to learn that revitalized entertainment and movie company, Angel Studios, generated over $200 million in gross revenue in 2023, primarily on the back of its box office smash hit, Sound of Freedom (which has now produced total box office sales of over $250 million since its launch on 04 July 2023).

{AUTHOR'S NOTE: This data was disclosed in Angel Studios' Form 8-K filing with the U.S. Securities and Exchange Commission on 11 September 2024. The "Sound of Freedom" revenue totals are disclosed on Slide No. 11 of the company's slide deck.}

But I'm getting ahead of myself.

Some two weeks ago, Provo, Utah-based Angel turned to its significantly supportive fanbase and its paying Guild members and announced on the Friday of Labor Day weekend (30 August 2024) that it was launching a crowdfunded, Reg A+ financial offering in an effort to raise upward of $20 million.

To be honest, this journalist felt the firm's timing was suspect at best given the Friday announcement, a specific day each year that many people leverage to turn a 3-day holiday weekend into a 4-day holiday weekend.

Put more bluntly, I was skeptical at that the Reg A+ funding effort would be successful.

At all.

Boy, was I wrong!

As it turns out, just shy of two weeks after announcing the launch of its Reg A+ offering, Angel Studios disclosed that it had successfully completed the fundraising, generating $20.0 million in gross proceeds for the company.

In fact, in the news release about the fundraising, Angel CEO, Neal Harmon said,

"Audiences are frustrated by what the Hollywood gatekeepers choose to greenlight for theaters and streaming. They feel most stories do not represent them. Now over 20,500 people have decided to take matters into their own hands by investing in Angel Studios."

So cool ... a successful two-week fundraising journey, right?!?!?!

Except Angel Studios wasn't done.

In fact, three hours before it announced the completion of its Reg A+ funding efforts, the company announced it was going to merge with publicly traded Southport Acquisition Corporation (OTC:PORT) , a special purpose acquisition company, also known as a SPAC.

AUTHOR'S NOTE: In reality, by taking the successful Reg A+ fundraising path, a path that saw the company gain over 20,500 shareholders during the past two-ish weeks, Angel Studios blew past the legally mandated threshold of 2,000 shareholders, a metaphorical "line in the sand" that would have forced Angel to begin publicly disclosing financial statements and other "material" information.

In essence, whenever a firm's total number of investors moves beyond 1,999 shareholders, the company must begin "acting like" a publicly traded enterprise, even if it decides to stay "private." Naturally, most firms nearing that demarcation line choose instead to take the "go public" pathway rather than remain private while trying to manage over 2,000 shareholders.

As explained by Investopedia, this 2,000-investor threshold was updated in 2012 in the JOBS Act from the previous threshold of 500 shareholders.

CLOSING OBSERVATIONS: Angel Studios and its Proposed SPAC Merger

So, if/when the announced SPAC Merger is completed (projected for the first half of 2025),

- The surviving entity would be Angel Studios,

- With Harmon as its CEO, and

- With its shares expected to be traded on either the NASDAQ Stock Market or the New York Stock Exchange.

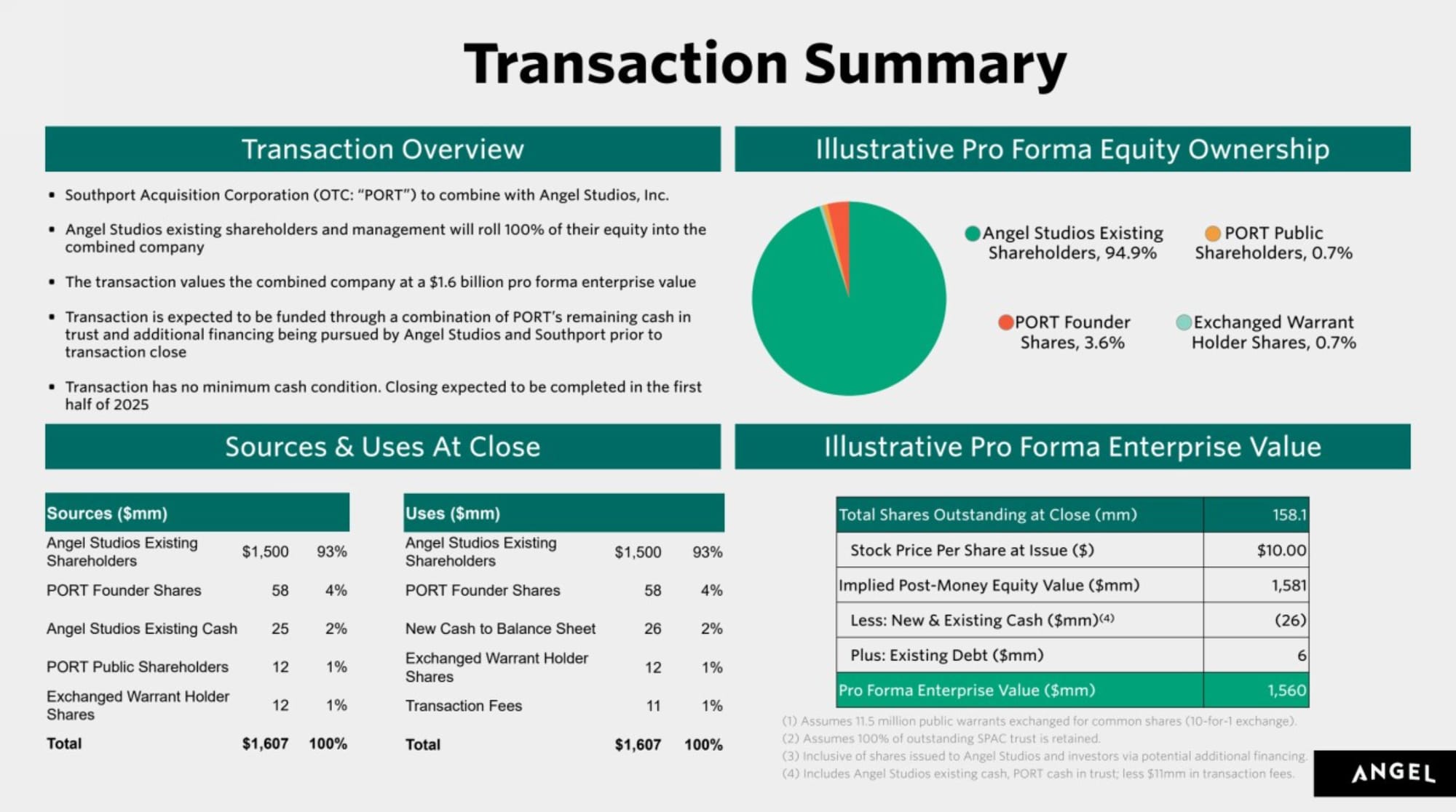

And if all goes according to plan (as outlined in Angel's Transaction Summary slide of its investor presentation on the SEC website — see below), the goals/expectations are that

- Angel would have 158 million shares outstanding post-merger,

- At a valuation of $10/share,

- Giving Angel a post-merger valuation of $1.58 billion, and

- With existing Angel shareholders holding a 93% ownership stake in the new firm.

In essence, by announcing its proposed SPAC Merger, Angel Studios has figuratively proclaimed to the world that as a private company, it's worth over $1 billion, immediately throwing itself (for the next few months, at least) into the ranks of Utah-based "Unicorns," firms valued over $1.0 billion.

Now ... will Angel Studios and Southport be able to pull-off this SPAC Merger?

Who the crap knows.

Maybe.

Probably.

In reality it's hard to say as SPAC Mergers tend to be tricky at best.

And clearly there's a lot of unknown highway between now and January 1st, let alone by the end of June 2025, such as

- Uncertainty about the economy,

- The outcome of the U.S. presidential election,

- The continuing war between Russia and Ukraine,

- Fighting in the Middle East, and

- Growing unease across America,

just to name a handful of disconcerting issues.

Nevertheless, if the financial success of Sound of Freedom has taught me anything, it's to not take anything for granted about Angel Studios.

At least not recently

So, for now, my sentiment is simple:

"Good on ya, Angel Studios. And good luck too!

PUBLISHER'S NOTE

Are you interested in timely Utah-focused monetary, financial, and/or business news, context, and analysis, content NOT currently available through any other source?

Then you should become a subscriber to Utah Money Watch. Today!

Simply,

1. Click on a "Subscribe" button on any Utah Money Watch webpage,

2. Enter in your name in the proper field in the popup window that appears on-screen, and

3. Enter your preferred email address in the proper field too.

That's it. And "Yes," it really is that simple.

And it IS free ... for now, at least.

So we hope to see you join us as a subscriber of Utah Money Watch.

Thanks.

Team Utah Money Watch

P.S. For context, the purpose of Utah Money Watch is to publish news, information, context, and analysis NOT available through any other source.

[You might think of us as the inverse of Bloomberg, CNBC, and/or The Wall Street Journal. In other words, we are passionately focused on uncovering the most important monetary, financial, and/or business news and information that impact the organizations and people of Utah first, followed by regional news/info second, and national/international info/news last of all.]

To that end, this article/report was originally published and distributed to our Subscribers at approximately 6:10am (MT) on Friday, 13 September 2024.

However, if this report/article came to your attention sometime after this date/time and you'd like to change that, then to become a subscriber, please follow the steps above.

Thx. DLP

Comments ()